Without really owning or managing Bitcoin directly, investors can get exposure to its price changes by investing in an Exchange Traded Fund for Bitcoin, or Bitcoin ETF.

Bitcoin Spot ETFs and Bitcoin Futures ETFs differ mainly in their basic assets, liquidity requirements, performance drivers, potential price divergence, and exposures.

Bitcoin ETFs have become a kind of a link which lets traditional investors experience the world of cryptocurrencies.

Applications for Bitcoin Spot ETFs have been received from financial institutions such as Fidelity, Invesco, BlackRock, and Ark Invest, and if the applications are verified, then the investors may have access to additional Bitcoin ETF.

Table of Contents

Read More: Understanding Matching Engines in Trading

What is an ETF?

Like stocks, exchange traded funds (ETFs) are types of investments. These funds are bought and sold through stock markets. These funds typically track the performance of a particular index or asset and hold a range of assets including stocks, commodities, and the cryptocurrencies.

An S&P 500 ETF buys shares of companies in this index. Its goal is to match the index’s performance. When the index changes, the ETF manager adjusts the fund’s holdings. They add or remove stocks accordingly. This keeps it aligned with the index. The ETF reflects what the S&P 500 contains. It tracks composition and performance closely.

ETFs get traded on stock exchanges. That means they can be purchased and sold based on supply and demand. During the trading day, the price is determined. This is unlike mutual funds whose net asset value (NAV) gets calculated once at day’s end.

The market price is what investors use to trade even though the NAV of ETFs is determined several times during the trading day. This approach differs greatly from mutual funds. Investors benefit from increased flexibility and liquidity. ETF users also access diverse trading strategies, options which are unavailable for mutual funds. Examples: short selling and buying on margin.

What Is a Bitcoin ETF?

Bitcoin exchange traded funds (ETFs) have become an important financial tool in the changing world of cryptocurrency investing. Investors don’t actually possess or control Bitcoin. Nonetheless, they can gain exposure to its price fluctuations through investing in a Bitcoin Exchange Traded Fund (ETF). Some investors prefer this type of exposure. The Bitcoin ETF trades on conventional stock exchanges like shares of a company and holds Bitcoin or contracts linked to its price. Interest in Bitcoin ETFs has increased as the market for cryptocurrencies grows, especially in the two primary varieties: Bitcoin Spot ETFs and Bitcoin Futures ETFs. Each allows different risk tolerances and investment approaches.

Who Should Consider Investing in Bitcoin ETFs?

Bitcoin Futures ETFs and Bitcoin Spot ETFs have significant differences. Investors should understand these differences. This knowledge helps in picking the right invester. If you desire direct exposure to Bitcoin’s fluctuating spot prices without difficulty of managing or safekeeping the digital asset, Bitcoin Spot ETFs are ideal. This person may be someone who favors investments that closely follow the market price of Bitcoin and who thinks the cryptocurrency has long term value. Additionally, they might prefer Spot ETFs’ ease of use to the complications of futures trading.

At the same time, the Bitcoin Futures ETFs serve experienced investors who are not only curious about the price of Bitcoin but also have easy experience navigating the complications of the futures market. By taking advantage of the characteristics of the futures market, they may be trying to take advantage of opportunities in short term price fluctuations or safeguarding other investments. This investor might be open to taking on the possible risks and benefits of trading futures, including the complexities of contract transfers.

What Bitcoin ETFs Are Available to Investors?

You can easily locate a list of these funds on reliable sources. Many Bitcoin and Ethereum exchange-traded funds exist for investing. If considering investing in these ETFs, carefully read fund details. Learn about liquidity, fund managers, and fees.

An ETF can have varied fees and expenses. Trading fees and management costs vary between ETFs. Be mindful of these charges, as they could affect investment gains. Always consider the ETF provider’s track record and reputation.

A safer choice may be well established fund managers with a strong track record. Examine the ETFs’ liquidity. Those that make it easy to buy or sell shares without major fluctuations in prices are usually better.

Various Bitcoin ETFs offer exposure to diverse cryptocurrencies. If expanding crypto investments interests you, ETFs holding various digital assets makes a good choice.

In 2023, prominent financial firms like Fidelity, Invesco, BlackRock, and Ark Invest applied to launch Bitcoin Spot ETFs. If approved, investors could access a wider range of Bitcoin ETFs soon.

What Is a Bitcoin Spot ETF?

It’s an Exchange Traded Fund holding Bitcoin as the key asset. The value of this ETF directly tracks Bitcoin’s current market price. In simple terms, a Bitcoin Spot ETF moves based on the value of Bitcoin itself. Even though they do not hold any Bitcoin personally, investors who purchase shares of a Spot ETF are effectively purchasing a representation of the cryptocurrency.

As an example, consider the “BTC-one” as the Bitcoin Spot ETF. Each share would theoretically represent 0.01 Bitcoin if BTC-one claims to hold 10,000 Bitcoins and has issued one million shares. It means that BTC-one’s performance has a clear connection with the current value of the Bitcoins it owns.

Benefits and Drawbacks of Bitcoin Spot ETFs

Acquiring a Bitcoin Spot ETF offers several advantages. Initially, it offers exposure to changes in the price of Bitcoin without requiring management or storage of the cryptocurrency, thus minimizing worries regarding digital wallets and security. Furthermore, by trading on traditional stock exchanges, these ETFs implement Bitcoin into a regulatory framework, which may give a greater audience a sense of trust. Lastly, because the Bitcoin Spot ETF follows the well-known stock trading framework, investing in one may be easier for conventional investors.

Like any investment, there are potential dangers though.

A Bitcoin Spot ETF’s value is subjected to changes in connection with the unpredictable price of bitcoin. Also, administrative problems or fees could mean that the ETF’s performance doesn’t always match with that of Bitcoin. Even though ETFs move Bitcoin closer to traditional banking and regulatory monitoring, there is still some unpredictability in the larger cryptocurrency market.

Lastly, because the ETF fees extra charges, trading ETFs is more expensive than trading spot cryptocurrency. ETF charges sometimes top 2.5 percent. On the other hand, crypto trades involve less fees. Note that Bitcoin, Ethereum, and other crypto Spot ETFs function alike. Their pros and cons are similar.

What is a Bitcoin Futures ETF?

Bitcoin Futures ETFs don’t actually purchase Bitcoin itself. Instead, they invest in contracts allowing purchase or sell of Bitcoin at a predetermined price on a future date. Investors can predict Bitcoin’s price movement without directly owning the cryptocurrency.

Think about, let’s say an exchange traded fund called “BitFutures” whose key purpose is buying Bitcoin futures contracts to follow Bitcoin’s future price. A financial institution runs BitFutures ETF. Imagine BitFutures plans to get 1,000 Bitcoin futures contracts. Each one gives the right to purchase one Bitcoin at $55,000 in three months.

“BitFutures” issues 10 million shares that represent a claim on the potential profits or losses that these futures contracts might produce in order to raise the funds needed to purchase these contracts. Hence, every share is similar to a claim on 0.0001 of each futures contract.

Investors can purchase BitFutures shares on regular stock exchanges in the same way that they would with any other company. In three months the shares may trade at a premium if the market believes that Bitcoin will be worth much more than $55,000. On the other hand, the shares could trade at a discount if the market is down.

We suppose BitFutures stock costs $10 per share. An investor purchases 1,000 shares for $10,000. This decision came from their belief that Bitcoin’s value will rise during the upcoming three months.If the futures contracts turn a profit, BitFutures shares should rise in value. Should their prediction prove accurate, and each share reaches $12. The $12,000 investment value would yield a $2,000 profit.

Investing in Bitcoin Futures ETFs like BitFutures doesn’t mean you get the cryptocurrency itself or futures contracts. It’s an indirect bet on Bitcoin’s expected value. You buy a stake in the fund that owns those contracts, nothing more. Ethereum Futures ETFs work in a similar way.

Benefits and Drawbacks of Bitcoin Futures ETFs

Bitcoin futures ETFs and Bitcoin spot ETFs have important similarities. They offer investors exposure to Bitcoin price movements, without directly owning or holding the cryptocurrency. Operating within regulated frameworks set by financial authorities, these ETFs follow established guidelines. Additionally, they provide enhanced liquidity compared to alternative investment options, enabling investors to smoothly trade ETF shares on traditional stock exchanges.

A Bitcoin Futures ETF’s major drawback is its indirect exposure to Bitcoin. Investors don’t own actual Bitcoins. Instead, they have shares in a fund investing in futures contracts. This means no direct Bitcoin ownership. Due to their dependence on the unpredictable futures market, the performance of the Bitcoin Futures ETFs can also be complicated. The value of Bitcoin Futures ETFs may not always move in parallel with the price of Bitcoin, aside from additional management fees that could lower returns. These ETFs face potential partner risks. This means the other party in the agreement may fail to fulfill their obligations. The issue lies in their inability or unwillingness to do what they promised. Such a situation exposes these ETFs to significant partner-related risks.

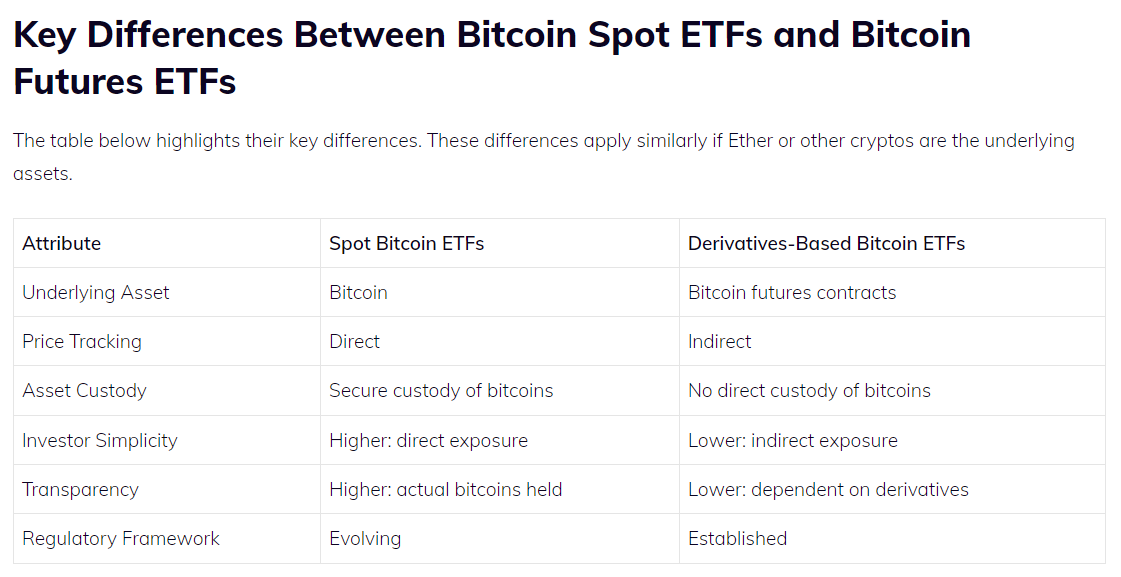

Key Differences Between Bitcoin Spot ETFs and Bitcoin Futures ETFs

The table below highlights their key differences. These differences apply similarly if Ether or other cryptos are the underlying assets.

| Attribute | Spot Bitcoin ETFs | Derivatives-Based Bitcoin ETFs |

| Underlying Asset | Bitcoin | Bitcoin futures contracts |

| Price Tracking | Direct | Indirect |

| Asset Custody | Secure custody of bitcoins | No direct custody of bitcoins |

| Investor Simplicity | Higher: direct exposure | Lower: indirect exposure |

| Transparency | Higher: actual bitcoins held | Lower: dependent on derivatives |

| Regulatory Framework | Evolving | Established |

Source By: Investopedia

Wrap-Up About Bitcoin ETF

Bitcoin ETF connect regular investors to cryptocurrencies. Bitcoin Futures ETFs use contracts predicting Bitcoin prices. Bitcoin Spot ETFs hold actual Bitcoin, exposing investors directly to price movements.

But as with any investment, you must proceed with extreme caution. Possible risks exist in the world of Bitcoin and its related investment vehicles. Interested investors should conduct complete study before making a choice. Possibly the most crucial step is speaking with a trustworthy financial advisor who can offer unique advice to each person’s financial objectives and risk tolerance.